features of bridging and end financing loan

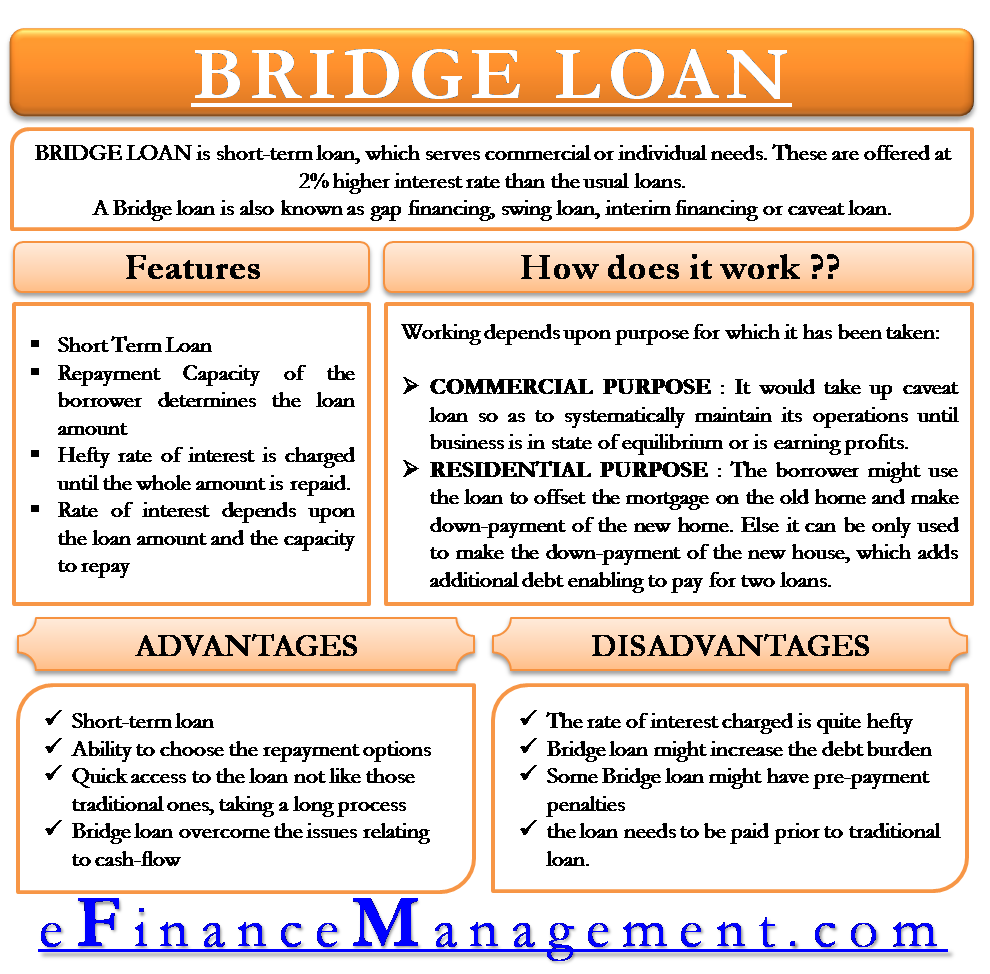

Borrowers of short-term bridging. A closed bridge loan has a fixed repayment date.

How And When To Use Bridge Loans In A Commercial Real Estate Deal

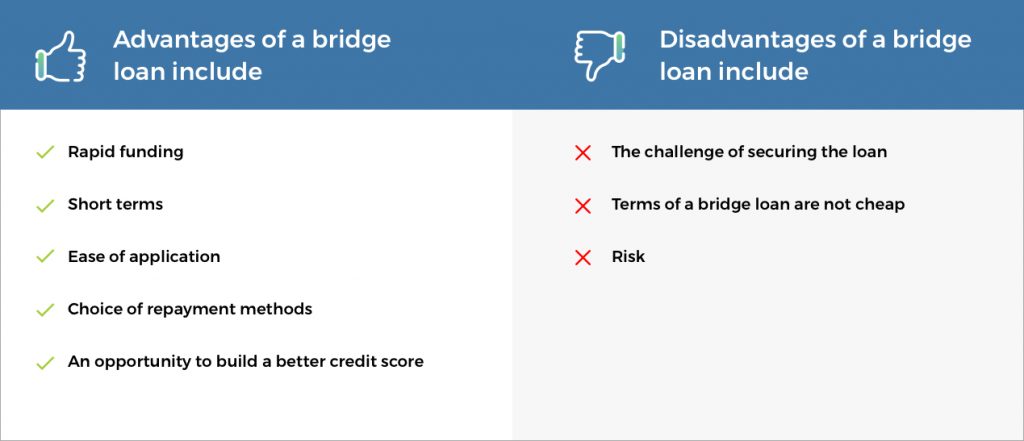

Their monthly rate of interest is high when compared to other methods of finance so should not be used as a long term option.

. The funds required to build a housing development can be quite extensive. All Credit History Accept Same Day Approval Apply Online Today. Bridging loans fall into two categories.

Light-refurbishment bridging loan features. Secured loans and Law of Property Act LPA Receivers When you take out a bridging loan you need to provide the lender with some form of security in. It is rare to have developers that fund the entire project on their own.

Although an end loan can have interest-only or other. Bridge loans are short term typically. Get a Business Loan Today.

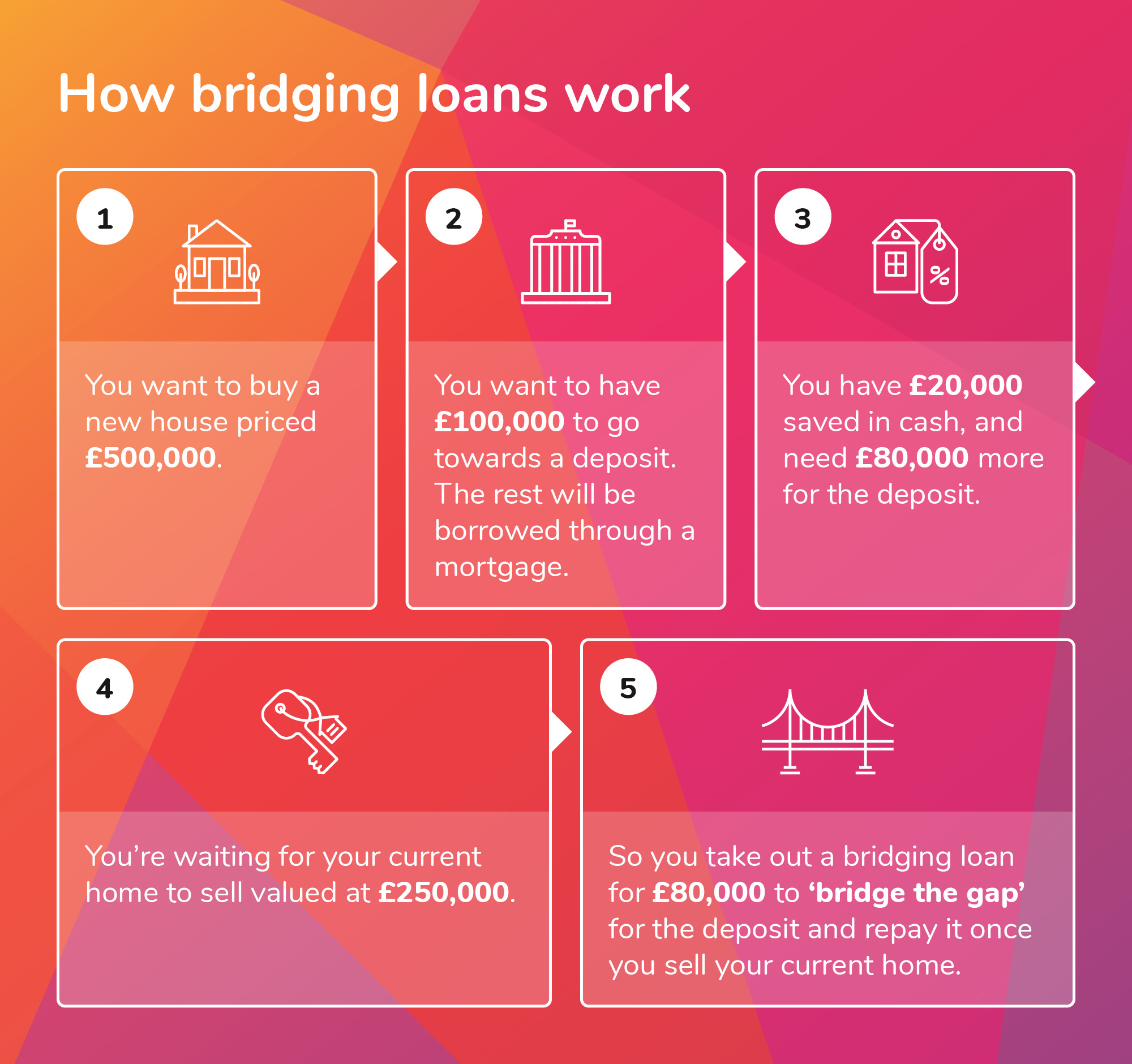

Bridging Loan End Financing Bridging Loan End Financing. A bridge loan is short-term financing used until a person or company secures permanent financing or removes an existing obligation. When you take out a bridging loan the lender usually takes over the mortgage on your existing property as well as financing the purchase of the new property.

They offer increased flexibility and lending criteria. The main purpose of a bridging loan is to bridge the finance gap so you can buy your new property before you find a buyer for your property. On a 250000 loan that has a 3 interest rate you might be paying 1054 for a conventional loan an amount that would rise to 1342 with a bridge loan that had a 2 higher.

Get a Business Loan Today. Ad Up to 90 LTV No Tax Returns Upfront Fees Or Junk Fees On Your Bridge Loan. Use Funds for Anything.

Bridging loans are usually offered for between 1-18 months with the loan repayable in full at the end of the term. Low Credit No Problem. In all cases bridge loans are expensive because lenders bear a significant portion of default risk loaning the funds for a short period.

Ad Compare 2022s Top Online Lenders. Things to consider with bridging finance. To maintain liquidity they.

2 Years in Business 200k Annual Revenue Recommended for Largest Selection. To repay the loan at the end of the term. 2 Years in Business 200k Annual Revenue Recommended for Largest Selection.

Ideally youll want to sell your property first. Bridging loans are only intended as a short term finance option. Loan extensions in professional short-term lending are a common occurrence during the nature of the type of borrowers we are lending to.

A lender offers you a loan to pay off the balance of your mortgage plus enough for a down payment. Ad Compare 2022s Top Online Lenders. A facility to ease your cash flow during the construction period pending receipt of proceeds from end purchasers or their end.

A permanent long-term loan used to pay off a short-term construction loan or other form of interim financing. Learn if You Quality in 2 Minutes or Less. Repayments on your bridging loan are usually calculated on an interest only basis during the time it takes to buy your new home and sell your existing home called the bridging.

Term bridging loans is far more commonly used than bridging financeBridging mortgages are exactly the same as a bridging loans and bridging finance there is no difference between the. Ad Get in Touch with us and we Will Help You to Create the Right Solution for Your Needs. A bridging loan is a great solution for property developers and investors that need fast funding for their property venture.

Ad Over 100 Million Customer. The total amount borrowed is. Your current mortgage is paid off and the.

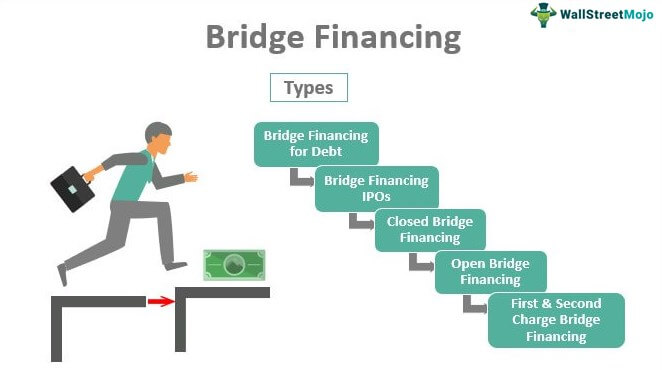

First mortgage bridge loan. Bridge financing is used in the initial public offerings. Light-refurbishment bridging loans have a slightly lower interest rate and is designed for smaller development projects.

Unlike other forms of borrowing the monthly interest is. If youre purchasing a property and are waiting for the sale to complete youll. Maximum term of 12 months with interest only capitalised repayments converting to principal and interest repayments on the new loan.

Loans Approved In Minutes No Fees Repay 3 - 36 Months Apply Now.

What Is A Bridging Loan Money Co Uk

How Do Housing Developers Get Money To Build Houses

Bridge Loans And Home Purchase Bridge Loans

Everything You Need To Know About Bridging Loans The European Business Review

Ultimate Guide To Hmo Bridging Finance 2020 Hmohub

Bridge Financing Meaning Examples How Does It Work

Project Financing Bridge Financing Gideongroup Net

0 Response to "features of bridging and end financing loan"

Post a Comment